Entrepreneurs Should Understand the Meaning of Setting Up KPI in Business – CyberAgent Ventures

Alice Fang, the manager of CyberAgent Ventures in Taiwan region, was the third speaker in “2015 Global and Taiwan’s Entrepreneurship Environment Communication Forum.” Her topic “How to Attract Ventures Capitals” directly focused on what she learned during her service in CyberAgent, and what challenging we are facing in Taiwan’s VCs environment.

Alice joined Japan Asian Investment in 2000, where she worked for 10 years before joining the CyberAgent Ventures team. “CyberAgent was founded in 1998 and so far we have around 3,000 employees in our company. In addition to investment, our business covers CyberBuzz, an online advertisement, Sumazap, a game company, and Ameba, a social media,” Alice said.

Alice mentioned that CyberAgent Ventures is not a Corporate Venture and therefore, they have to look for funds from enterprises, including telecommunication companies and banks. Their investment targets focuses on areas in Asia, Southern Asian and the United States where they have 11 offices in 8 different counties. Among those companies they invested, IPO companies includes 14 companies in Japan, Youku Tudou, a China’s video sites, UserJoy Technology, a company involved in PC single-player/MMO game development, and iPartment, an online dating website of Taiwan. “We invested four enterprises in Taiwan, which are iPartment, icook, iPeen and FashionGuide.”

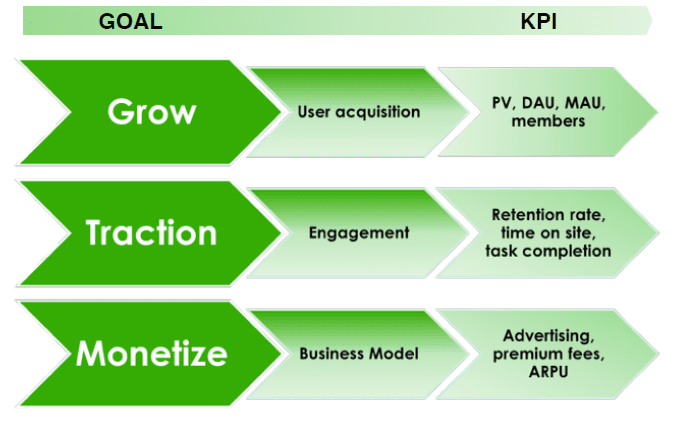

Different Phases of KPI Require Different Resources

“The evaluation of enterprise investments by CyberAgent Ventures are similar as others – team, services, market, business model, competitors and potential of the product or service. I will focus on the team and business model in today’s talk,” Alice said.

“Every enterprise has its goal in different phases. We have limited resources and thus we have to do it efficiently to carry on the best result of its KPI in every phase.” Alice divided the growth of an enterprise into three phases – Growth, Traction, and Profit.

1. Growth: User Acquisition

When your company’s goal is growth, the most important emphasis is to benefit users. KPI would be set based on PV, DAU, MAU and numbers of members.

2. Traction: Engagement

Traction has been one of the popular focus in the startup circle, which means the degree of attraction in the market. To develop a successful traction, enterprises should focus on its KPI on the maintenance rate of users, the achievement of users’ purposes.

3. Profit: Business Model

Enterprises need to design a complete business model for profits. Also, they need to focus on their advertisements, fee services and average revenue per uses (ARPU), and etc.

“However, some of VCs request those KPIs from your company not only to analyze by the data, but also to understand the thoughts and directions of your company.”

“At the end, a company always faces two directions, M&A or IPO. A company need to carefully consider its possibility of IPO. The purpose of IPO is to get more investments from the market, but if the company itself does not have enough assets, they should consider another option, M&A,” Alice said.

How Does a VC Evaluate a “Team”?

Alice listed some team evaluations from a VC’s perspective:

1. Founder

The founder is not the whole of a team, but it plays an essential factor to manage a good business. “I personally would not invest teams that founded by couples or spouses. Things will get more complicated if they want to separate one day,” Alice said, amusedly.

2. CEO and COO

Another important factor is the team’s CEO and COO

3. Ages

A team members’ ages are highly related to their business. When evaluating potential investments in B2C business, Alice used to aim on teams composed of members in their 30s. To invest B2B business, she usually looks for teams with members in their 40 years old.

4. Background and Education

5. Recruitment

Numbers and methods of a company’s recruitment are related to the structure of shares in a company.

6. Cost

How much does a company spend on the team?

Team Shareholding vs. Investor Shareholding

There are three types of share structures – Team Shareholding, Investor Shareholding and ESOP. “We have a relatively low percentage of Team Shareholding, and that would affect investors’ willingness on investing Taiwanese companies.”

“In my opinion, after obtaining series A, a team should keep its shares above 50%”

中文版連結

封面照片:PanX

留言討論