Is equity crowdfunding the way out for entrepreneurs in Taiwan?

Translated by 半月

To help startups springing up like mushrooms in recent years get their funding, Taiwanese government made equity crowdfunding legal last year (2015), making Taiwan the seventh country in the world, second in Asia with the possibility to do crowdfunding.

In October 2015, DIT Startup, founded by five gaming companies, got the first non-securities equity crowdfunding license, providing spaces, crowdfunding platforms and investment funds. On December 30th, 2015, DIT Startup Equity Crowdfunding Platform got online, becoming the first platform of this kind founded by business incubator.

This time, PanX came to the Dream Talks business forum for a lecture given by Chih-Ying Huang, manager from DIT Startup‘s Investment Division. She talked about development of equity crowdfunding in the world, in Taiwan and how startups can benefit from this.

Crowdfunding v.s. Equity Crowdfunding: What’s the difference?

Equity Based Crowdfunding had developed thanks to social network and online payment mechanisms. This gives companies a new approach to raise money. Generally speaking, crowdfunding can be roughly categorized into three forms: Reward Based, Equity Based and Debt Based.

● Reward Based Crowdfunding

In this most well-known form of crowdfunding, people post their projects onto the platform to raise funds and use their service of product to reward their “backers”. It is relatively easy to execute the project and more quickly to get funds this way. The backers, people who “back” the project, will “not” take part in the operation of the fundraising company. Kickstarter, Indiegogo and flyingV are examples of this form.

● Equity Based Crowdfunding

Enterprises use this form of crowdfunding to get long-term source of funding. The biggest difference between Equity Based and Reward Based Crowdfunding is that in Equity Based Crowdfunding, backers become shareholders who will play a role in the operation of the company.

● Debt based crowdfunding

There are two types of debt-based crowdfunding, namely P2P (Peer to Peer) and P2C (Peer to Company) funding. The world’s most famous platform for P2P crowdfunding, Lending Club, was listed on the New York Stock Exchange since December, 2014. However, this service is not yet made legal in Taiwan.

Example of famous Equity Based Crowdfunding Platforms

● AngelList (U.S.A)

AngelList is the crowdfunding platform which has the most investors in the US. To invest of projects, people on AngelList have to get accredited first. And fundraising companies need to submit funding project for the platform for analysis, evaluation and valuation.

● Crowdcube (U.K.)

Crowdcube is the first Equity Based Crowdfunding platform in the world, which was founded in 2011. Not until 2013 was the company recognized as providing legal service by the Financial Conduct Authority (FCA) in the UK. Crowdcube is now the most popular platform in the UK. The minimum amount of investment is 10 pounds and the sky’s the limit.

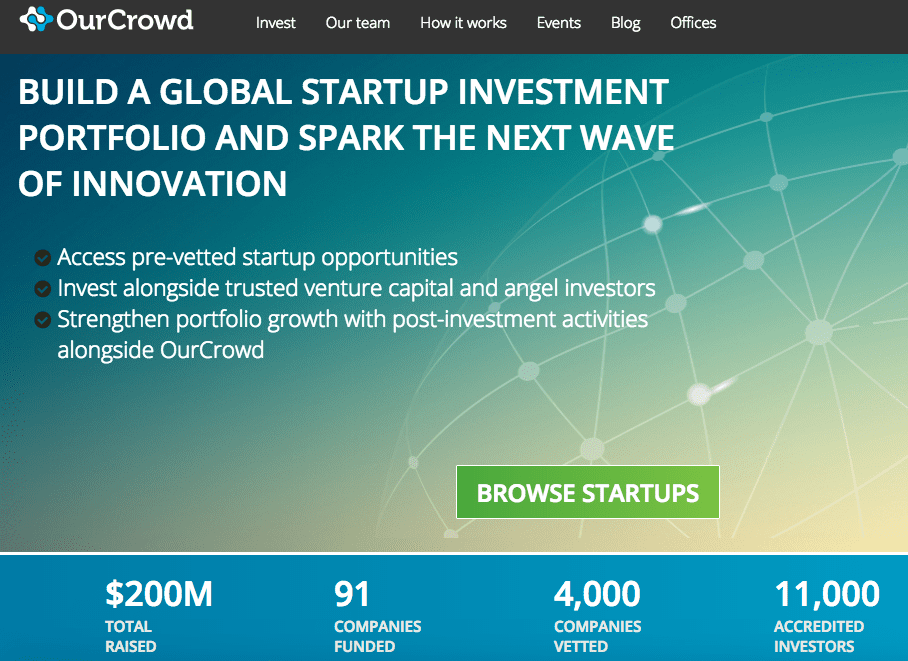

● OurCrowd (Israel)

OurCrowd has a rigorous screening process for fundraising projects. In average, only 2 to 3 out of a hundred projects make it to the end. This is because OurCrowd itself invests on every qualified project which makes the platform stand by investors’ side. Another feature worth mentioning is that OurCrowd combines “traditional venture capital” and “angel investor” models, making the platform’s world’s highest record in Equity Based Crowdfunding.

● AngelCrunch (China)

AngelCrunch is the earliest and biggest Equity Based Crowdfunding platform in China. A famous example is DiDi transportation, which got the funding on AngelCrunch and became huge success.

Taiwan is slowly catching up

There are nearly 3,000 active Equity Based Crowdfunding Platform in the world. One third of them were U.S. based. In Europe, we see rapid development in the UK, France and Germany while Asia is the fastest growing area. The number of Equity-based crowdfunding projects skyrocketed mainland China in 2015. However, lack of monitoring mechanisms caused a chaotic situation. Chinese government promised to address this issue in the second half 2016.

Globally speaking, we see different models in Equity Based Crowdfunding around the world. Governments are

working on legal aspects and related policies to follow this trend.

In April 2015, Taiwanese government released ‘Taipei Exchange Regulations Governing the Conduct of Equity Crowdfunding by Securities Firms”, officially making Equity Based Crowdfunding legal. From July to December 2015, several platforms popped out. Today, we see 3 platforms in the market: First Securities, MasterLink Securities and DIT Startups.

According to Huang, Taiwan is the second country with Equity Based Crowdfunding Platforms. However, things did not work out well because of the relatively restrict rules and small amount of projects. “ For example, fundraising groups should have authorized capital no more than 30 million NT dollars (NTD), no public offering stock. Each project can only be raising funds on one platform at a time. For individual investors (natural persons), signal fundraising project is not allowed to exceed 50 thousand NTD, 100 thousand NTD per year.”

Equity Based Crowdfunding, more than raising money

Besides raising money, Equity Based Crowdfunding can be seen as a marketing strategy. The company can take this as an opportunity to interact with potential customers. Nowadays, there are a variety of ways to raise funds. Entrepreneurs should carefully evaluate the goal and status quo of the company to find the best approach to get the funding of the company.

中文版連結

Cover photo via Tax Credits@flickr, CC License

留言討論