Now you get your funding. What’s next? (Part I)

Translated by 半月

Money is often the biggest problem that a startup would face from the very beginning. Countless projects die in the process of fundraising. Because of this, many entrepreneurs share their experiences about getting venture capital, investors and pitching in business forums. However, are you curious about the next step? Shall we use the money to hire sales person or engineers? What are some problems that cannot be solved with money?

This time in School for Entrepreneur Forum, guest speakers talk about the “next steps” after getting the capitals. We are pleased to invite Brad, co-founder of Deepblu, John, co-founder of CardinalBlue and Ben, co-founder of the Taiwanese venture capital firm Mesh Ventures.

Deepblu: communication, goal and control

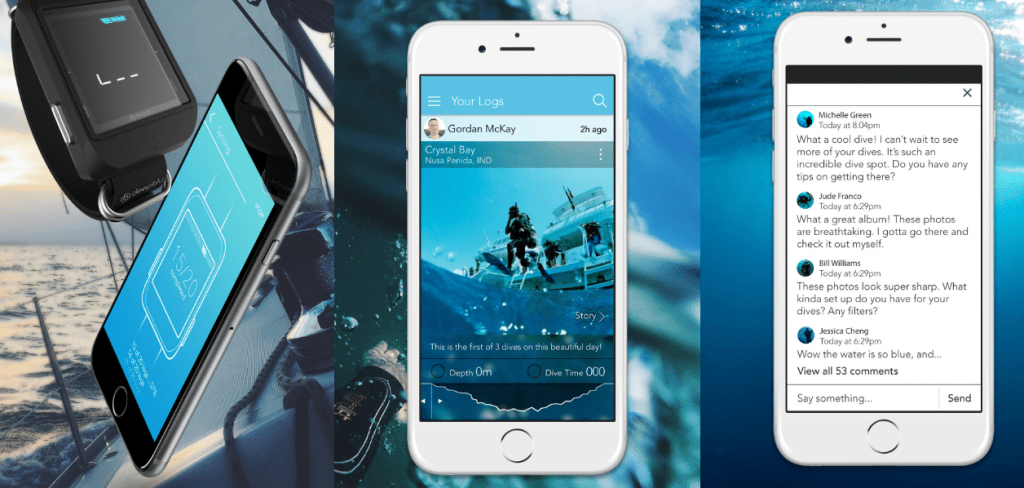

Brad Chen is the co-founder of Deepblu, a startup providing diving log and social network service that sells also their diving smart watch. They just receive seed funding last year in 2015. Before Deepblu, Brad worked in the semiconductor and IT industry for 12 years. But he never forget his passion for diving.

“Deepblu was founded in 2013, providing diving product and service. We aimed to build a service emphasizing the social aspect of this sport, which is based on sharing people’s experience. Last month, we released Deepblu in Singapore. Our goal is to become a international company.”

“Many people thought that Deepblu was just a wearable device or a watch for diving. It is more than that. Diving itself is very enjoyable, just like flying in the blue sky. But do you know how painful it is to sit down and write the diving log afterwards? Our platform is here to solve this pain. Deepblu helps you upload what you have seen during the diving session, including dive profiles, depth value and scenes and share them with friends.”

According to Brad, they are the first company with this technology in Taiwan. The price of the watch is set to be 10,000 NT dollars (around 300 USD). The estimated revenue this year can hit 100 million. “I have a dream that one day human being will treat the ocean in a more friendly way. We unintentionally destroy things that we don’t understand well. The ocean is dying. However, I believe that people will change after getting to know the ocean.”

“Many people asked me how to spend the money. Well, I believe that the funding means responsibility. It’s just the beginning. You should be thinking about the next steps. ”

“There are 3 important things. The first is communication. As a leader, you need good communication with the board of directors and your investors. You may even want to meet with them more often than your wife (he laughed). The second is your goal. Sometimes people forget their goals after they receive funding. This may lead to inefficiency of the company’s operation.

“Finally, controlling is important. There should be a controller in the group. This person monitors spending. There are always people who don’t know at all how their money are spent in the company.”

PicCollage: Choosing the right amount of funding

The second lecturer was the co-founder of CardinalBlue. In 2011, their photography app PicCollage was released in 500 Startups accelerator and was downloaded for 400 thousand times in the very first month. “We realized that there weren’t that many competitors. Or, maybe PicCollage is really special.” The co-founder John Fan said that they raised 2.7 million US dollars in the silicon valley, which is a seed funding that is almost enough to be called a Series A.

“ VCs are looking for small restaurants that will become the next Mos Burger. As entrepreneurs, you have to give them the vision, even illusion.”

Raising money is like blowing up a balloon, said John. “If you tell the investors that you are a red balloon, just like Google. They believe you and give you that huge amount of money. And then, BANG! You may explode. But if you just got the right amount of money, you could become a beautiful balloon.”

When it comes to fundraising, John has 3 advice.

- Most start-ups should not go immediately for VC.

- Be careful when choosing investors.

- Try to MAKE MONEY instead of going for fundraising again.

“Many entrepreneurs say that we should be careful about money because maybe we will not get any more in the future. However, the investors may not tell you this. Listening to the investor’s advice, we moved to a new office and did lots of marketing and investment turned out not suitable for us. The investors want there money back. It’s true. But only you know what you should do!”

“There are two kinds of start-ups: unicorns and money makers. While unicorns are relatively rare, please try to earn more money!”

“If you want our money, please figure out first what we are doing.” -Mesh Ventures

“When trying to find investment target, we want groups that jump into bigger industry, at least 1 billion worth. Mesh Ventures invest mostly on American and Asian companies, including areas like Smart City, Industry 4.0, and security-related industries. We care about what problems these systems can solve. Before coming to us, please make sure you have good explanation on the data you collected.”

Ben Liu, co-founder of Mesh Ventures says that you can do whatever you want with the money you get. If you are in seed round or A round, you may be still working on prototypes. In series B or C, the business model is clear. You need money to make it big. Some people want to make products. Others prefer branding. It all depends on your company and the industry.

“If there’s a group asking for 50 million dollars and as I walk in their office, I see a gigantic marble structure. I will start to ask myself: are they spending their money on marbles? And I will most likely not spend my money on this company. And finally, can money help you find the right employees? I personally think that smart guys have their own goals. They may not work for you because of those marbles. What you, as the owner of the company, want to do in the future is the key.”

“By the way, I would say adding your own salary with the money raised is usually not a good idea.”

中文版連結

Cover photo from PanX

留言討論